P.L.A.D.™ Financial Ratio Analysis

P.L.A.D.™ Financial Ratio Analysis can help to greatly clarify understanding of performance improvement fundamentals for two main groups of app users: 1) business owners, executives and managers – plus the accountants, advisors, consultants, board members, bankers and investors who work with them; 2) teachers of business/accounting-related courses, as well as the high school and university-level students they teach.

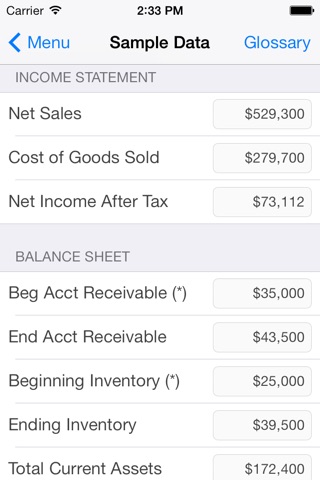

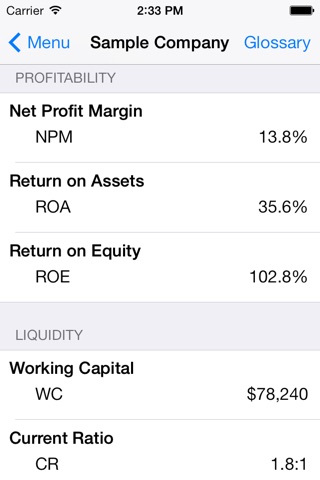

By inputting 13 specified dollar values into the app – 10 from Balance Sheets and 3 from Income Statements – a user can automatically calculate/view the Financial Ratio Analysis results for three key Profitability measures, three key Liquidity measures, six key Activity measures and three key Debt measures. These performance results include:

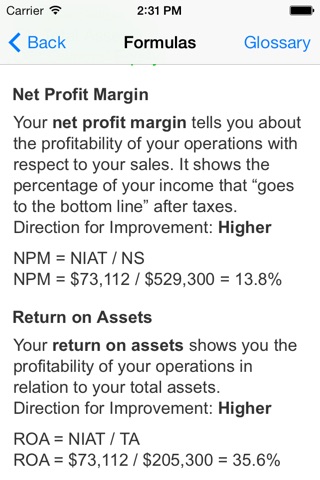

Net Profit Margin (Return on Sales)

Return on Assets

Return on Equity

Working Capital

Current Ratio

Quick Ratio

Accounts Receivable Turnover

Assets Turnover per Period

Inventory Turns per Period

Days Sales in Inventory

Average Accounts Receivable

Average Inventory Held

Financial Leverage

Long-Term Debt to Capital

Debt to Assets Ratio

The app comes pre-loaded with 13 entered dollar values taken from a sample Balance Sheet and Income Statement (both provided within the app) that highlight in green color each line item containing a variable used by the apps ratio analysis formulas. This makes it easier to find the 13 required dollar values on your companys Balance Sheets and Income Statements.

P.L.A.D.™ Financial Ratio Analysis incorporates a set of interconnected performance-analysis variables, which means that a change in one or more of the entered dollar values will likely produce multiple adjustments in the calculated/displayed results across all included measurements of Profitability, Liquidity, Activity and Debt.

The app offers valuable guidance on the importance and potential significance of each ratio analysis result. It also shows the component variables that comprise each formula and indicates whether the “direction for improvement” in a particular result generally means aiming for a higher or lower number. In addition, users will enjoy convenient access to a useful Glossary of all the ratio analysis-related terms, formulas and variables used in the app.